With clear regulations, rising institutional adoption, and rapid technological embrace propelling markets from Singapore to the Philippines, India must urgently craft a unified crypto policy to avoid being left behind.

Southeast Asia is fast emerging as a global hub for virtual digital assets (VDAs) or cryptocurrency trading. Governments across the region have taken proactive and transparent stances, institutional investment is soaring, and technology adoption rates are unprecedented. From Singapore to the Philippines, each country’s tailored approach is fueling innovation while steadily ironing out regulatory challenges.

Singapore Leads with Pro-Innovation Policies

The Monetary Authority of Singapore (MAS) has rolled out crypto-friendly regulations. A landmark move is the Singapore Exchange’s plan to list Bitcoin Perpetual Futures in the second half of 2025—an offering designed specifically for institutional investors. This step underscores Singapore’s ambition to bridge traditional finance with digital markets.

Thailand Strengthens Consumer Protections

Thailand’s Securities and Exchange Commission (SEC) now mandates that all exchanges store client assets in secure, auditable cold wallets. Tourists are even permitted to pay with Bitcoin, and licensed exchanges benefit from a five-year tax holiday on transactions—measures that both encourage legitimacy and safeguard users.

Vietnam Prepares Comprehensive Legal Framework

By May 2025, Vietnam aims to unveil a sweeping legal structure covering ownership rights, anti-money laundering safeguards, taxation, and licensing. While cryptocurrencies have yet to gain official status as a payment method, the forthcoming regulations signal the government’s intent to formally recognize digital assets.

Indonesia Issues Clear Guidelines for Financial Institutions

Effective January 2025, Indonesia’s Financial Services Authority (OJK) Regulation 3/2024 provides explicit directives on how financial entities should utilize and report new technologies such as cryptocurrencies. The goal: responsible innovation underpinned by robust risk management.

Philippines Boasts a Vibrant Retail Market

The Filipino crypto ecosystem is among the region’s most dynamic. Platforms like Coins.ph process over two million transactions daily across 18 million users. Driven by a young demographic and steady remittance inflows, digital finance has become both a necessity and a vehicle for greater financial inclusion.

Institutional Interest Grows

Major players are entering the fray. FalconX’s partnership with Standard Chartered will launch institutional crypto services in Singapore before expanding across Asia—proof that professional demand is quickly following retail momentum.

Persistent Challenges: Illicit Activity

Despite progress, risks remain. The U.S. Financial Crimes Enforcement Network (FinCEN) recently accused Cambodia-based Huione Group of laundering $4 billion in cryptocurrency, underscoring the urgent need for strong anti-money laundering laws and cross-border regulatory cooperation.

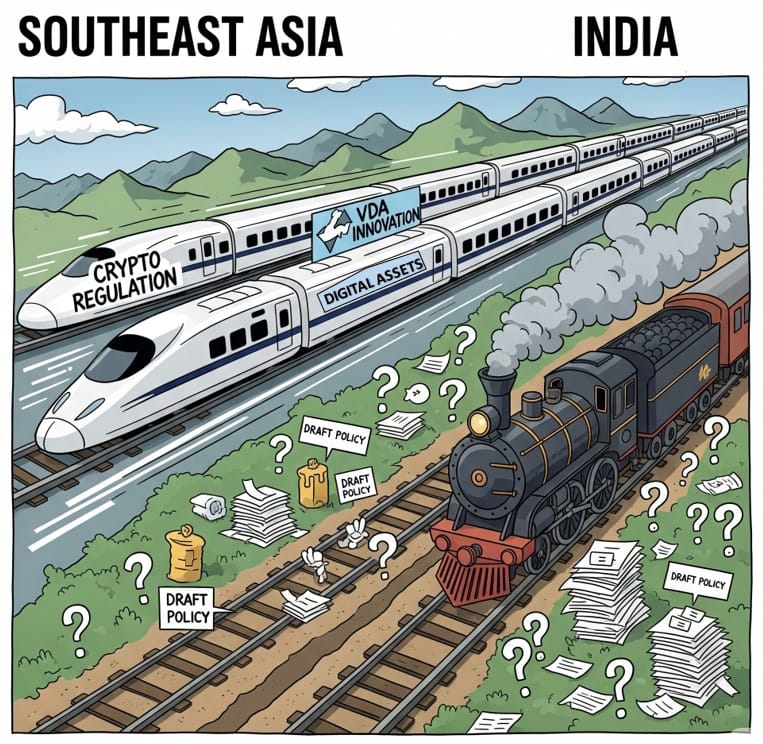

India’s Regulatory Vacuum

As Southeast Asia forges ahead, India’s crypto policy remains fragmented and reactive. Coordination among ministries is weak, draft regulations are yet to materialize, and although taxes on crypto transactions exist, a clear overarching framework does not. This regulatory uncertainty has sown confusion among investors and left startups in limbo.

The Way Forward for India

India needs a cohesive policy roadmap. First, it should convene an inter-ministerial committee to set out clear guidelines for VDAs. Equalizing tax treatment between crypto and fiat transactions would also make the market more accessible. A transparent regulatory regime that safeguards investors while promoting innovation is essential if India hopes to stake its claim in the rapidly evolving digital asset landscape.